Joe Blogg is the owner of a bakery called Sweet & Sour that has been in operation

Question:

Joe Blogg is the owner of a bakery called Sweet & Sour that has been in operation since 1 May 20x2.

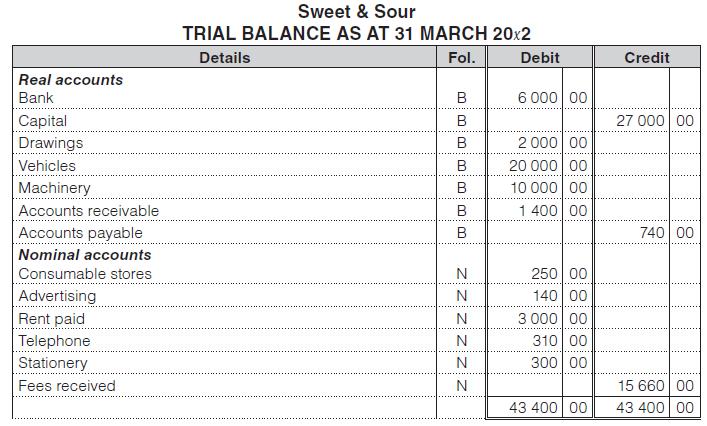

The trial balance as at 31 March 20x2 reflects all the transactions recorded for the period 1 May 20x2 to 31 March 20x2.

Transactions for April 20x2, last month of the financial year:

1 Joe Blogg increased his capital contribution by depositing a further R2 000 into the business’s bank account.

2 Received a cheque from P. Platt for R165 in settlement of his account.

3 Bought colourants and other baking material from Sasko and sent a cheque for R210.

4 S. Scott sent us a cheque for R235 in settlement of his account.

5 Joe Blogg purchased stationery from Paperbacks on account, R155. Recorded as an expense at acquisition.

6 Cash takings from services rendered, R578.

7 The owner took a redundant machine, valued at R350 in the books, for his personal use.

8 Baked for school functions on behalf of these receivables on credit:

![]()

9 Bought new machinery from Machines R Us on account, R2 300.

10 Paid the telephone account of R120 by cheque.

11 Received a statement of account from Adverts Incorporated for advertising done on our behalf, R355.

12 B. Brett sent us a cheque for R900 in full settlement.

13 Received the bank statement detailing charges, R15.

14 These adjustments must be made at the end of the period to facilitate more accurate reporting:

– Vehicles must be depreciated by 15% of their value in the books.

– Machinery is to be valued at R10 500, the difference being depreciation.

– Stationery on hand, R150.

You are required to:

1. Enter the transactions and adjustments into the general journal.

2. Post to the general ledger accounts.

3. Close the nominal accounts to the profit and loss account by passing general journal entries and then post to the ledger accounts.

4. Prepare a statement of profit or loss & other comprehensive income and statement of financial position.

5. Comment on the financial performance and position of Sweet & Sour.

Step by Step Answer:

Fundamental Accounting

ISBN: 9781485112112

7th Edition

Authors: David Flynn, Carolina Koornhof, Ronald Arendse, Anna C. E. Coetzee, Edwardo Muriro, Louise Christel Posthumus, Louise Mancy Smit