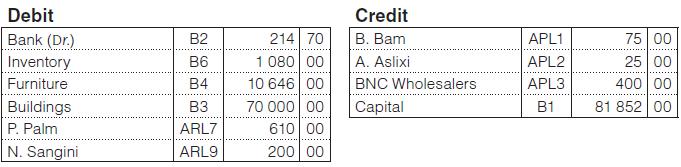

Here are some of the balances from Luminary Traders on 1 February 20x3. All inventory is

Question:

Here are some of the balances from Luminary Traders on 1 February 20x3.

• All inventory is marked up by 50% on cost.

• The perpetual inventory system is used.

Transactions for February 20x3:

4 Sold goods on account to N. Sangini, R80.46 (invoice 73).

Sold goods on account to P. Palm, R14.70.

5 Paid R325 for goods bought from BNC Wholesalers and issued cheque 417.

Bought filing cabinet on account from Tafelberg Furnishers, R340 (invoice 101).

Cash sales, R174.75 (K135).

9 Received cheque number R109 from P. Palm to settle his account on 1 February 20x3.

Paid the electricity account by cheque, R63.42.

Bought on account from B. Bam (invoice 999):

![]()

Total of cash sales to date, R369.51.

11 Sent a cheque to B. Bam for R75 to settle our account on 1 February 20x3.

Sold old furniture for cash to N. Boshof, R90. The carrying value of the furniture sold was R90.

Received a cheque from I. Lume, the owner, to increase his capital contribution, R5 000.

Bought goods and paid by cheque, R460.

Received an account from Clive’s Garage for repairs to the business’s equipment, R146.45.

Drew a cash cheque for R600, R520 was for wages and the rest was taken by the owner.

14 Sold goods on account to N. Sangini, R170. He subsequently sent a cheque to settle his account as at 1 February 20x3.

Bought a new delivery van from Clive’s Garage, R8 940. Sent a cheque to pay the 15% deposit.

Issued a cheque to Telkom to settle the telephone account, R41.30.

Merchandise sold for cash, R642.

Bought inventory on account from:

![]()

18 Paid wages by cheque, R550.

Bought inventory from B. Bam and paid by cheque, R170.

Received a cheque from N. Sangini for R100 in part settlement of his account.

Issued a receipt to A. Tenant for premises sublet to him, R800.

28 Had a special cash sale to get rid of old inventory.

– Takings from the sale amounted to R1 530.

– The selling price was reduced by 33.33% for the sale.

– Paid wages, R710.

You are required to:

1. Enter the above transactions in the cash receipts journal, cash payments journal and the general journal. (Ignore VAT.)

2. Close off the subsidiary journals correctly and post to the ledgers.

Step by Step Answer:

Fundamental Accounting

ISBN: 9781485112112

7th Edition

Authors: David Flynn, Carolina Koornhof, Ronald Arendse, Anna C. E. Coetzee, Edwardo Muriro, Louise Christel Posthumus, Louise Mancy Smit