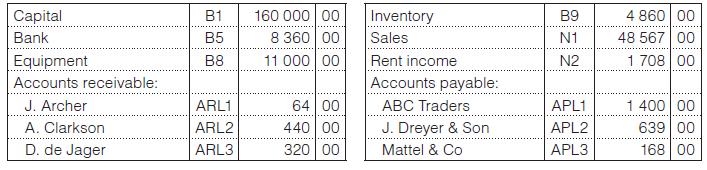

Here are some of the balances from the books of Link Stores on 1 February 20x6. Additional

Question:

Here are some of the balances from the books of Link Stores on 1 February 20x6.

Additional information:

• The pricing policy is to mark inventory up by 40% on cost, which has been done consistently to date.

• The business uses the perpetual inventory system.

• All money received is deposited immediately and all payments are made by cheque.

Transactions for February 20x6:

1 Received a cheque from A. Poll for a storeroom sublet to him for R854 (receipt 143).

Cash sale of merchandise R964.60 (CS 321–361).

J. Archer sent a cheque in settlement of his account.

Received an account from Mattel & Co for R340 for repairs to the business’s computer system (invoice 99).

4 Paid R64.80 to the postmaster for telephone (D345).

Sent a cheque to the City Treasurer for R184.70 to pay the electricity account.

Bought inventory from ABC Traders invoiced to the business at R680.

Received a cheque from A. Clarkson to settle his account on 1 February.

5 Sent a cheque to J. Dreyer & Son for R349

Inventory sold for cash R846.30 (CS 362–400).

7 Sold inventory to Archer that cost the business R150 (invoice 75).

Received an invoice from Kwikprint for letterheads printed R86.

The owner took inventory for his own use R160.30 cost price.

Issued a cheque to ABC Traders for R1 000. This was in part settlement of account.

The balance of the account was settled by ABC Traders, taking over an old delivery van for the amount due.

14 Cash sales, R1 750.14 (CS 201–223).

Issued a cheque to Lyther & Co for stationery, R46 and inventory, R382.

Sold merchandise to D. de Jager, selling price was R350.

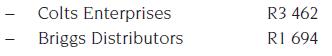

Bought inventory from:

Donated inventory from the storeroom to the local high school for their annual fee with a cost price of R630.

19 The owner increased his capital contribution by giving his vehicle for use in the business.

It was valued at R6 870.

Sold an old office printer to P. Prigg for R150 cash.

Bought merchandise from J. Dreyer & Son and paid by cheque, R300.

24 Bought petrol from Windies’ Motors and paid by cheque R78.53.

Settled Mattel & Co’s account in full.

Paid the wages of the business by cash cheque, R1 480.

Sent a cheque to J. Dreyer & Son to settle the amount outstanding.

28 Total of inventory sold for cash R1 965.60. Included in this amount was inventory that had been sold for R616. The selling price had been reduced by 20% because they were soiled.

Received the bank statement and noted that the following charges had been made against the business:

Service fees R44.85; and cash handling fees R36.90.

You are required to:

1. Record the above transactions in the general journal.

2. Post from the general journal to the general ledger.

Step by Step Answer:

Fundamental Accounting

ISBN: 9781485112112

7th Edition

Authors: David Flynn, Carolina Koornhof, Ronald Arendse, Anna C. E. Coetzee, Edwardo Muriro, Louise Christel Posthumus, Louise Mancy Smit