Q, S and T are partners in Quesentee. The partnership agreement provides for the following: 1. Capital

Question:

Q, S and T are partners in Quesentee. The partnership agreement provides for the following:

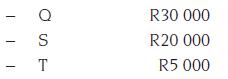

1. Capital remain unchanged at:

2 When dividing profits and losses, this information must be taken into account:

a. Q and S each receive a salary of R2 000 per year. T receives R3 000 plus a bonus of 10% of the profits, after providing for all interests and salaries.

b. Each partner earns interest on capital at 6% per annum. Interest on current accounts is calculated at 10% per annum.

c. Interest on drawings is calculated at 6% per annum. In the current year, drawings were as follows: Q, R350; S, R200; T, R400.

d. R2 250 of the profit must be transferred to the general reserve account.

e. The remaining profit must be divided in the ratio 6 : 3 : 1.

Additional information:

• Net profit for the year amounted to R21 850.

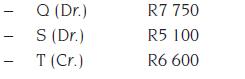

• Balance on the current accounts:

You are required to:

Record all the transactions above in the general journal of Quesentee for the year ending 30 June 20x5. (Narrations should be included.)

Step by Step Answer:

Fundamental Accounting

ISBN: 9781485112112

7th Edition

Authors: David Flynn, Carolina Koornhof, Ronald Arendse, Anna C. E. Coetzee, Edwardo Muriro, Louise Christel Posthumus, Louise Mancy Smit