This information concerning the year ended 28 February 20x3 was extracted from the books of H. Jump

Question:

This information concerning the year ended 28 February 20x3 was extracted from the books of H. Jump and V. Spring: (Ignore VAT.)

1. Net profit, before taking into account the salaries of partners, interest on capital, interest on current accounts, and interest on drawings, amount to R25 765.

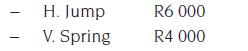

2. Salaries of partners:

![]()

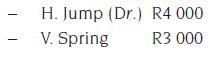

3. Drawings:

4. Current accounts (as at 1 March 20x2):

These conditions are contained in the partnership agreement of H. Jump and V. Spring:

1. Their capitals are to remain unchanged at these amounts:

2. Each partner is to receive interest on capital at 12% per annum.

3. Drawings are subject to 10% per annum on daily balances. For the year ended 28 February 20x3, this is calculated as:

4. Interest on the balances of current accounts (as they appear at the beginning of each year) is to be calculated at 10% per annum.

5. The remainder of the profit or loss (after the above-mentioned have been brought into account) is to be shared in proportion to capital.

You are required to:

Prepare the current accounts of the partners for the year ended 28 February 20x3 as they should appear in the ledger. All the necessary adjustments need to be taken into account.

Step by Step Answer:

Fundamental Accounting

ISBN: 9781485112112

7th Edition

Authors: David Flynn, Carolina Koornhof, Ronald Arendse, Anna C. E. Coetzee, Edwardo Muriro, Louise Christel Posthumus, Louise Mancy Smit