Quo Vadis Ltd would like to purchase additional non-current assets that cost R100 000 and is considering

Question:

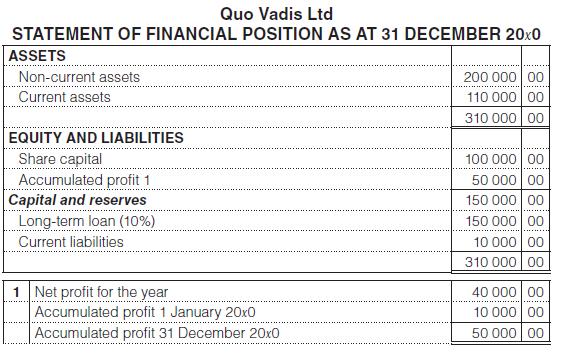

Quo Vadis Ltd would like to purchase additional non-current assets that cost R100 000 and is considering borrowing R100 000 from Ratios Ltd at 10% per annum to finance this. (Ignore taxation and assume that the present return on assets will be maintained on the new fixed assets.)

You are required to:

1. Calculate these three ratios of relevance to Quo Vadis Ltd, using the present information (before the loan) and after the loan:

a. Debt to equity ratio.

b. Debt ratio.

c. Return on equity.

2. Calculate these two ratios for Ratios Ltd to help them decide whether to grant the loan, using the present information (before the loan) and after the loan:

a. Return on assets.

b. Interest cover.

3. Based on your calculations in Questions 1 and 2, will Ratios Ltd be prepared to finance Quo Vadis Ltd? State briefly why or why not.

Note

Restrict your written comments to an absolute minimum and base them only on the ratios that you have calculated.

Step by Step Answer:

Fundamental Accounting

ISBN: 9781485112112

7th Edition

Authors: David Flynn, Carolina Koornhof, Ronald Arendse, Anna C. E. Coetzee, Edwardo Muriro, Louise Christel Posthumus, Louise Mancy Smit