Brooks Ltd makes sports shoes. You have been asked to analyse the companys financial position and, in

Question:

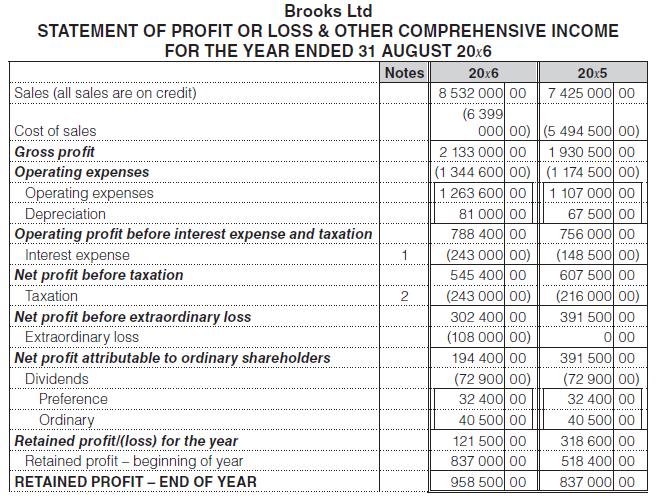

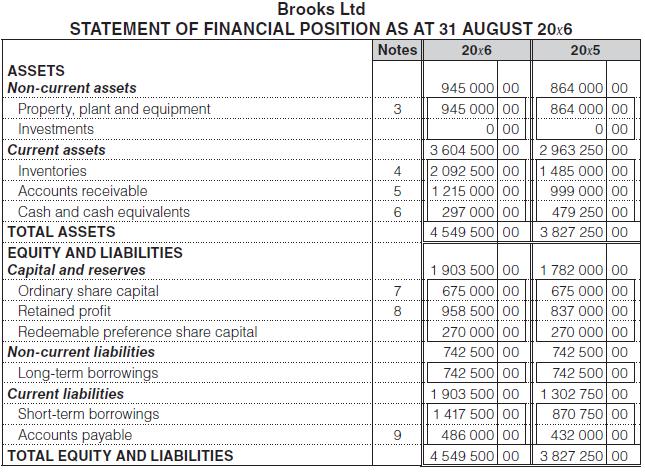

Brooks Ltd makes sports shoes. You have been asked to analyse the company’s financial position and, in particular, to assess the management of current assets and the use of debt.

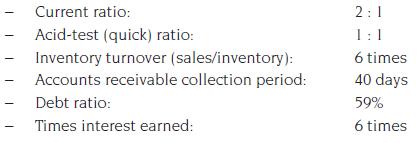

Additional information:

1. The company’s share capital consists of 675 000 shares of R1 each (market value R4.70).

2. The preference shares are redeemable on 1 September 20x9.

3. Industry ratios for 20x6:

You are required to:

1. Calculate the relevant ratios for 20x6 and 20x5 to analyse the company’s liquidity position and management of current assets. Comment on your findings.

2. Calculate the relevant ratios for 20x6 and 20x5 to analyse the company’s use of debt to finance its operations. Comment on your findings.

3. Calculate the company’s earnings and dividend yields for 20x6.

The draft financial statements for 20x6 and 20x5 are presented below:

Step by Step Answer:

Fundamental Accounting

ISBN: 9781485112112

7th Edition

Authors: David Flynn, Carolina Koornhof, Ronald Arendse, Anna C. E. Coetzee, Edwardo Muriro, Louise Christel Posthumus, Louise Mancy Smit