These balances appeared in the books of Bogey Stores as at 1 April 20x3: Ignore VAT. The

Question:

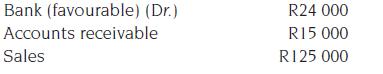

These balances appeared in the books of Bogey Stores as at 1 April 20x3:

Ignore VAT.

The amount owing by receivables was made up as follows:

Transactions for April 20x3:

1 Cash sales, R1 200.

5 Received from V. Leigh, R2 000.

9 Cash sales, R1 500.

12 Cash sales, R900.

16 Received from L. Olivier, R2 500.

20 Cash sales, R1 300.

23 Received from L. Bacall, R2 000.

27 Received from V. Leigh in settlement of her account, R2 000.

30 Cash sales, R1 400.

You are required to:

Record the transactions of Bogey Stores in the:

1. Cash receipts journal.

2. Accounts receivable ledger.

3. General ledger for the affected accounts.

Step by Step Answer:

Fundamental Accounting

ISBN: 9781485112112

7th Edition

Authors: David Flynn, Carolina Koornhof, Ronald Arendse, Anna C. E. Coetzee, Edwardo Muriro, Louise Christel Posthumus, Louise Mancy Smit