Zeke Company owns a proved property with the following costs: (separate amortization base) Zeke Company sells 100%

Question:

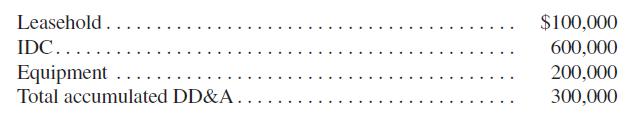

Zeke Company owns a proved property with the following costs:

(separate amortization base)

Zeke Company sells 100% of the working interest in the property to Torrance Company for $700,000.

REQUIRED:

a. Give the entry for Zeke Company to record the sale assuming that Zeke uses the successful efforts method.

b. Give the entry for Zeke Company to record the sale assuming the property had sold for $400,000.

c. Give the entry for part a and part

b, assuming Zeke Company is a full cost company and the reserves sold constitute 15% of Zeke’s share of reserves in the cost center.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: