Consider the following information: 1. On December 1, 2022, a U.S. firm plans to sell a piece

Question:

Consider the following information:

1. On December 1, 2022, a U.S. firm plans to sell a piece of equipment [with an asking price of 200,000 units of a foreign currency (FC)] during January of 2023. The transaction is probable, and the transaction is to be denominated in euros.

2. The company enters into a forward contract on December 1, 2022, to sell 200,000 FC on February 1, 2023, for $1.02.

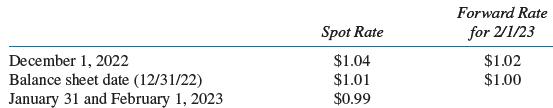

3. Spot rates and the forward rates for January 31, 2023, settlement were as follows (dollars per euro):

4. On January 31, the equipment was sold for 200,000 FC. The cost of the equipment was $170,000.

Required:

A. Prepare all journal entries needed on December 1, December 31, January 31, and February 1 to account for the forecasted transaction, the forward contract, and the transaction to sell the equipment.

B. Prepare any entry needed on February 1 to reclassify amounts from other accumulated comprehensive income into earnings.

Step by Step Answer: