The comparative financial statements for Advanced Auto Technology, Inc., are in the Working Papers. The financial statements

Question:

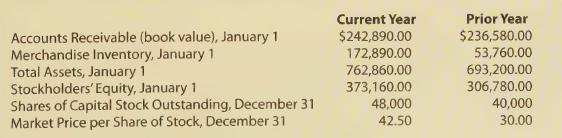

The comparative financial statements for Advanced Auto Technology, Inc., are in the Working Papers. The financial statements have been completed up to the financial analysis section. The following information is taken from the financial records of Advanced Auto Technology for two fiscal years ended December 31:

Instructions:

1. Complete the following comparative financial statements using trend analysis. Round percentage calculations to the nearest 0.1%.

a. Comparative income statement

b. Comparative stockholders’ equity statement

c. Comparative balance sheet

2. Use the financial statements’ trend analysis to determine whether the trend from the prior to the current year for each oft he following items appears to be favorable or unfavorable. Give reasons for these trends.

a. Net sales

b. Net income

c. Total stockholders’ equity

d. Total assets

3. Complete the comparative income statement using component percentage analysis. Round percentage calculations to the nearest 0.1%.

4. Record from the statement prepared in Instruction 3 or calculate the component percentages for each of the following. Determine whether the current year’s results, compared with those for the prior year, appear to be favorable or unfavorable. Give reasons for your responses.

a. As a percentage of net sales:

(1) Cost of merchandise sold

(2) Gross profit on operations

(3) Total operating expenses

(4) Net income after federal income tax

b. As a percentage of total stockholders’ equity:

(1) Retained earnings

(2) Capital stock

c. As a percentage of total assets or total liabilities and stockholders’ equity:

(1) Current assets

(2) Current liabilities

5. Based on Advanced Auto Technology's comparative financial statements, calculate the following ratios for each year.

a. Profitability ratios:

(1) Rate earned on average total assets

(2) Rate earned on average stockholders’ equity

(3) Rate earned on net sales

(4) Earnings per share

(5) Price-earnings ratio

b. Efficiency ratios:

(1) Accounts receivable turnover ratio (2) Merchandise inventory turnover ratio

c. Short-term financial strength ratios:

(1) Working capital

(2) Current ratio

(3) Acid-test ratio

d. Long-term financial strength ratios:

(1) Debt ratio

(2) Equity ratio

(3) Equity per share

6. For each of the items in Instruction 5, indicate whether a favorable or an unfavorable trend occurred from the prior to the current year. Give reasons for these trends.

Step by Step Answer: