CoffeeStop primarily sells coffee. It recently introduced a premium coffee-flavored liquor. Suppose the firm faces a tax

Question:

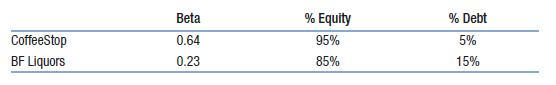

CoffeeStop primarily sells coffee. It recently introduced a premium coffee-flavored liquor. Suppose the firm faces a tax rate of 22% and collects the following information.

If it plans to finance 15% of the new liquor-focused division with debt and the rest with equity, what WACC should it use for its liquor division? Assume a cost of debt of 5.2%, a risk-free rate of 2.8%, and a risk premium of 5.6%.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals Of Corporate Finance

ISBN: 9781292437156

5th Global Edition

Authors: Jonathan Berk, Peter DeMarzo, Jarrad Harford

Question Posted: