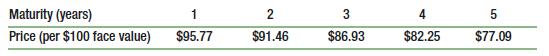

The following table summarizes prices of various default-free zero-coupon bonds (expressed as a percentage of face value):

Question:

The following table summarizes prices of various default-free zero-coupon bonds

(expressed as a percentage of face value):

a. Compute the yield to maturity for each bond.

b. Plot the zero-coupon yield curve (for the first five years).

c. Is the yield curve upward sloping, downward sloping, or flat?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals Of Corporate Finance

ISBN: 9781292437156

5th Global Edition

Authors: Jonathan Berk, Peter DeMarzo, Jarrad Harford

Question Posted: