The projected net income and free cash flows next year for Emerald City Paints are given in

Question:

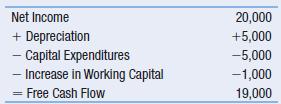

The projected net income and free cash flows next year for Emerald City Paints are given in the following table in $ thousands:

Emerald City expects capital expenditures and depreciation to continue to offset each other, and for both net income and increase in working capital to grow at 4% per year. Emerald City’s cost of capital is 12%.

If Emerald City were able reduce its annual increase in working capital by 20% by managing its working capital more efficiently without adversely affecting any other part of the business, what would be the effect on Emerald City’s value?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals Of Corporate Finance

ISBN: 9781292437156

5th Global Edition

Authors: Jonathan Berk, Peter DeMarzo, Jarrad Harford

Question Posted: