In the previous problem, construct the balance sheet for the new corporation assuming that the transaction is

Question:

In the previous problem, construct the balance sheet for the new corporation assuming that the transaction is treated as a purchase for accounting purposes. The market value of All Gold Mining’s fixed assets is $2,800; the market values for current and other assets are the same as the book values. Assume that Silver Enterprises issues $8,400 in new long-term debt to finance the acquisition.

Data from Exercises 5

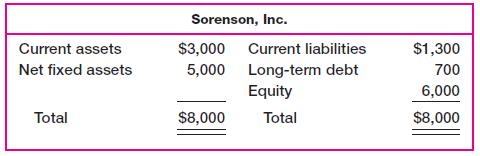

In the previous problem, suppose the fair market value of Sorenson’s fixed assets is $10,000 versus the $5,000 book value shown. Sipowicz pays $14,000 for Sorenson and raises the needed funds through an issue of long-term debt. Construct the postmerger balance sheet now, assuming that the purchase method of accounting is used.

Data from Problem 4

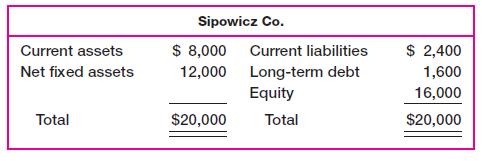

Assume that the following balance sheets are stated at book value. Construct a postmerger balance sheet assuming that Sipowicz purchases Sorenson and the pooling of interests method of accounting is used.

Step by Step Answer:

Fundamentals Of Corporate Finance

ISBN: 9780072553079

6th Edition

Authors: Stephen A. Ross, Randolph Westerfield, Bradford D. Jordan