In the previous problem, suppose the fair market value of Sorensons fixed assets is $10,000 versus the

Question:

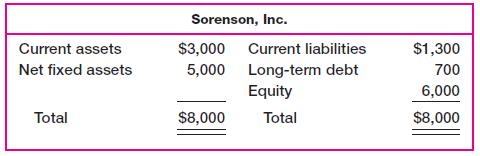

In the previous problem, suppose the fair market value of Sorenson’s fixed assets is $10,000 versus the $5,000 book value shown. Sipowicz pays $14,000 for Sorenson and raises the needed funds through an issue of long-term debt. Construct the postmerger balance sheet now, assuming that the purchase method of accounting is used.

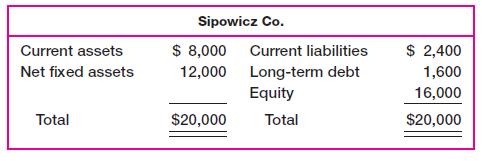

Data from Previous Problem

Assume that the following balance sheets are stated at book value. Construct a postmerger balance sheet assuming that Sipowicz purchases Sorenson and the pooling of interests method of accounting is used.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals Of Corporate Finance

ISBN: 9780072553079

6th Edition

Authors: Stephen A. Ross, Randolph Westerfield, Bradford D. Jordan

Question Posted: