In the coming year, the Sandbergs expect a rental property investment costing ($120,000) to have gross potential

Question:

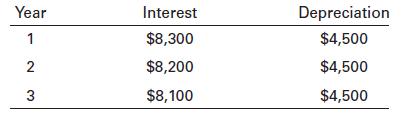

In the coming year, the Sandbergs expect a rental property investment costing \($120,000\) to have gross potential rental income of \($20,000,\) vacancy and collection losses equaling 5% of gross income, and operating expenses of \($10,000.\) The mortgage on the property is expected to require annual payments of \($8,500.\) The interest portion of the mortgage payments and the depreciation are given below for each of the next 3 years. The Sandbergs are in the 25% marginal tax bracket.

The net operating income is expected to increase by 6% each year beyond the first year.

a. Calculate the net operating income for each of the next 3 years.

b. Calculate the after-tax cash flow for each of the next 3 years.

Step by Step Answer:

Fundamentals Of Investing

ISBN: 9781292153988

13th Global Edition

Authors: Scott B. Smart, Lawrence J. Gitman, Michael D. Joehnk