Frank Myers, CFA, is a fixed-income portfolio manager for a large pension fund. A member of the

Question:

Frank Myers, CFA, is a fixed-income portfolio manager for a large pension fund. A member of the Investment Committee, Fred Spice, is very interested in learning about the management of fixed-income portfolios. Mr. Spice has approached Mr. Myers with several questions.

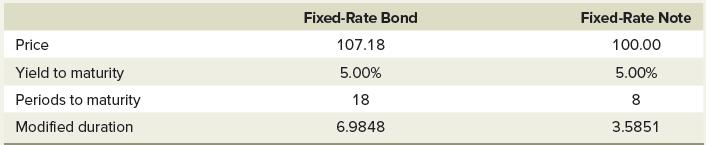

Mr. Myers has decided to illustrate fixed-income trading strategies using a fixed-rate bond and note. Both bonds have semiannual coupons. Unless otherwise stated, all interest rate changes are parallel. The characteristics of these securities are shown in the table below.

1. Mr. Spice asks Mr. Myers how a fixed-income manager would position his portfolio to capitalize on his expectations of increasing interest rates. Which of the following would be the most appropriate strategy?

a. Lengthen the portfolio duration.

b. Buy fixed-rate bonds.

c. Shorten the portfolio duration.

2. Mr. Spice asks Mr. Myers to quantify the value changes from changes in interest rates. To illustrate, Mr. Myers computes the value change for the fixed-rate note. He assumes an increase in interest rates of 100 basis points. Which of the following is the best estimate of the change in value for the fixed-rate note?

a. −$7.17

b. −$3.59

c. $3.59

3. For an increase of 100 basis points in the yield to maturity, by what amount would the fixed-rate bond’s price change?

a. −$7.49

b. −$5.73

c. −$4.63

4. Mr. Spice wonders how a fixed-income manager would position his portfolio to capitalize on the expectation of an upward-shifting and twisting term structure. For the twist, interest rates on long-term bonds increase by more than those on shorter-term notes.

a. Sell bonds and buy notes.

b. Buy bonds and sell notes.

c. Buy both bonds and notes.

Step by Step Answer:

Fundamentals Of Investments Valuation And Management

ISBN: 9781266824012

10th Edition

Authors: Bradford Jordan, Thomas Miller, Steve Dolvin