Question: Assume that you are purchasing shares in a company in the variety store and gas bar supply business. Suppose you have narrowed the choice to

Assume that you are purchasing shares in a company in the variety store and gas bar supply business. Suppose you have narrowed the choice to BFI Trading Ltd. and Lin Corp. and have assembled the following data:

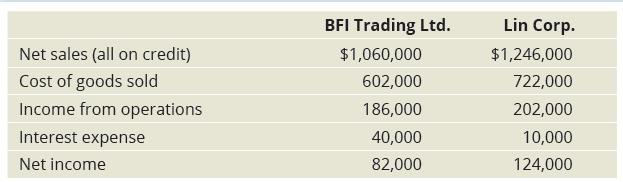

Selected income statement data for the year ended December 31, 2020:

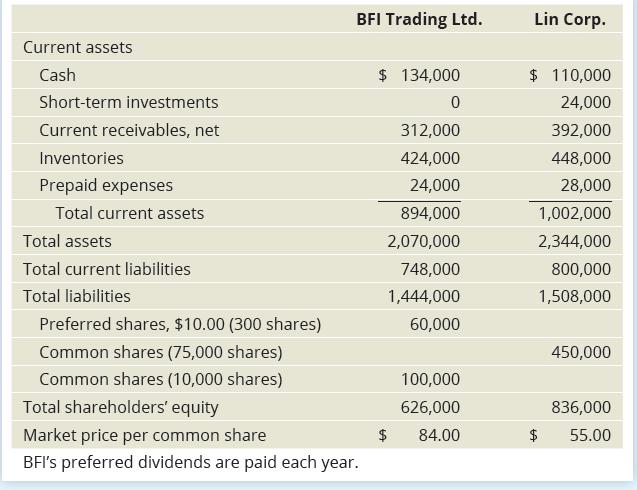

Selected balance sheet and market price data for the year ended December 31, 2020:

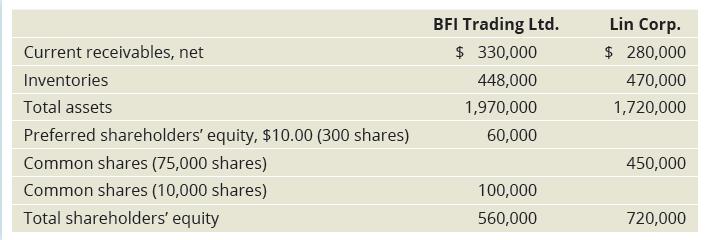

Selected balance sheet data at January 1, 2020:

Your investment strategy is to purchase the shares of companies that have low price– earnings ratios but appear to be in good shape financially. Assume you have analyzed all other factors and your decision depends on the results of the ratio analysis to be performed.

Required

Compute the following ratios (rounded to two decimal places) for both companies for the current year and decide which company’s shares better fit your investment strategy:

a. Current ratio

b. Acid-test ratio

c. Inventory turnover

d. Days’ sales in inventory

e. Accounts receivable turnover

f. Days’ sales in receivables

g. Debt ratio

h. Debt/equity ratio

i. Times-interest-earned ratio

j. Return on sales

k. Return on assets

l. Return on common shareholders’ equity

m. Earnings per common share

n. Price–earnings ratio

o. Book value per common share

BFI Trading Ltd. Lin Corp. Net sales (all on credit) $1,060,000 $1,246,000 Cost of goods sold 602,000 722,000 Income from operations 186,000 202,000 Interest expense 40,000 10,000 Net income 82,000 124,000

Step by Step Solution

3.33 Rating (150 Votes )

There are 3 Steps involved in it

a Current ratio Current assets ... View full answer

Get step-by-step solutions from verified subject matter experts