Presented below are three independent situations. Instructions (a) On January 1, 2015, Langley Co. issued 9% bonds

Question:

Presented below are three independent situations.

Instructions

(a) On January 1, 2015, Langley Co. issued 9% bonds with a face value of \($700\),000 for \($656\),992 to yield 10%. The bonds are dated January 1, 2015, and pay interest annually. What amount is reported for interest expense in 2015 related to these bonds?

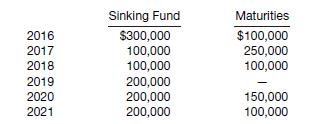

(b) Tweedie Building Co. has a number of long-term bonds outstanding at December 31, 2015. These long-term bonds have the following sinking fund requirements and maturities for the next 6 years.

Indicate how this information should be reported in the financial statements at December 31, 2015.

(c) In the long-term debt structure of Beckford Inc., the following three bonds were reported: mortgage bonds payable \($10\),000,000; collateral trust bonds \($5\),000,000; bonds maturing in installments, secured by plant equipment \($4\),000,000. Determine the total amount, if any, of debenture bonds outstanding.

Step by Step Answer:

Intermediate Accounting IFRS Edition

ISBN: 9781118443965

2nd Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield