Teri Hatcher Inc., in its first year of operations, has the following differences between the book basis

Question:

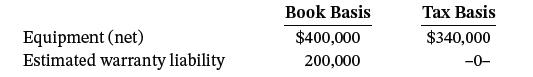

Teri Hatcher Inc., in its first year of operations, has the following differences between the book basis and tax basis of its assets and liabilities at the end of 2024.

It is estimated that the warranty liability will be settled in 2025. The difference in equipment (net) will result in taxable amounts of $20,000 in 2025, $30,000 in 2026, and $10,000 in 2027. The company has taxable income of $520,000 in 2024. As of the beginning of 2024, the enacted tax rate is 34% for 2024–2026, and 30% for 2027. Hatcher expects to report taxable income through 2027.

Instructions

a. Prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2024.

b. Indicate how deferred income taxes will be reported on the balance sheet at the end of 2024.

Equipment (net) Estimated warranty liability Book Basis $400,000 200,000 Tax Basis $340,000 -0-

Step by Step Answer:

a Income Tax Expense Deferred Tax Asset Income Taxes Payable Deferred Tax Liability Future taxable d...View the full answer

Intermediate Accounting

ISBN: 9781119790976

18th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield

Students also viewed these Business questions

-

Adelphi Corp. in its first year of operations has the following differences between its carrying amounts and the tax bases of its assets and liabilities at the end of 2020. It is estimated that the...

-

Teri Hatcher Inc., in its first year of operations, has the following differences between the book basis and tax basis of its assets and liabilities at the end of 2008. It is estimated that the...

-

Adelphi Corp. in its first year of operations has the following differences between its carrying amounts and the tax bases of its assets and liabilities at the end of 2017. It is estimated that the...

-

The emergency room of the community hospital in Farmburg has one receptionist, one doctor, and one nurse. The emergency room opens at time zero, and patients begin to arrive some time later. Patients...

-

What are the key authorization points in a payroll system?

-

Refer to Data Set 28 "Chocolate Chip Cookies" in Appendix B and use the counts of chocolate chips from the three different types of Chips Ahoy cookies. Use a 0.01 significance level to test the claim...

-

True or False: If \(\operatorname{IRR}(\mathrm{A})>\operatorname{IRR}(\mathrm{B})\), then \(\operatorname{ERR}(\mathrm{A})>\operatorname{ERR}(\mathrm{B})\).

-

Installment-Sales Method and Cost-Recovery Method on January 1, 2010, Wetzel Company sold property for $250,000. The note will be collected as follows: $120,000 in 2010, $90,000 in 2011, and $40,000...

-

In the estimation of international trade's casual effect on country's income, InYa+BT+yWi+i, = where Y; denotes income per person, T; denotes international trade, W; denotes within-country trade and...

-

The owner of Neros company has hired you to analyze her company's performance and financial position, as well as the positions of Iits competitors, Centar and Xermix. However, the data Neros abtained...

-

following information is available for the pension plan of Radcliffe Company for the year 2025. Instructions a. Compute pension expense for the year 2025. b. Prepare the journal entry to record...

-

Nadal Inc. has two temporary differences at the end of 2024. The first difference stems from installment sales, and the second one results from the accrual of a loss contingency. Nadals accounting...

-

Recall the Texas case Del Lago v. Smith from Chapter 1. In that case, a bartender served drinks when it was obvious that drunken patrons were about to engage in a dangerous bar fight. Smith, who...

-

In practice, how is any remaining fund balance of a completed Capital Projects Fund used? a. Frequently, a governing body will specify what shall be done with any remaining fund balance before the...

-

What method of accounting does GAAP require for inventories in an Internal Service Fund? a. Consumption method. b. Purchases method. c. Acquisition method. d. All of the above are acceptable...

-

Which method of cash flow reporting is used to report operating activities? a. Indirect method. b. Direct method. c. Either the indirect or direct method, depending on the method chosen for the...

-

The actuarially based charges to the General Fund from a Self-Insurance Internal Service Fund should be reported in the Internal Service Fund as a. transfers. b. revenues. c. special items. d....

-

In the government-wide financial statements, activities of an Internal Service Fund are a. always reported as governmental activities. b. always reported as business-type activities. c. reported...

-

Suppose a firm has a defined benefit pension plan and faces a marginal tax rate on ordinary income of 35%. The firm can earn or issue fully taxable bonds that yield 12% and can purchase stock...

-

One hundred pounds of water at atmospheric pressure are heated from 60F to 200F. What is the enthalpy change? The internal energy change? Why is the difference between the internal energy change and...

-

Explain the difference between the proportional method and the incremental method of allocating the proceeds of lump-sum sales of share capital.

-

Explain the difference between the proportional method and the incremental method of allocating the proceeds of lump-sum sales of share capital.

-

What are the different bases for share valuation when assets other than cash are received for issued shares?

-

Tamarisk, Inc. was organized on January 1. During the first year of operations, the following plant asset expenditures and receipts were recorded in random order. Debit 1. Cost of filling and grading...

-

"What is the role of scenario analysis and simulation techniques in planning for uncertainty and ambiguity? Additionally, how do alternative future scenarios inform risk management strategies,...

-

Three new 3D printers were purchased for use by the city clerk's office using General Fund resources. The printers cost $15,400 each: the city's capitalization threshold is $5,400. Which of the...

Study smarter with the SolutionInn App