Grand Corp.s 20X2 financial statements showed the following: Additional information: During the year, equipment with an original

Question:

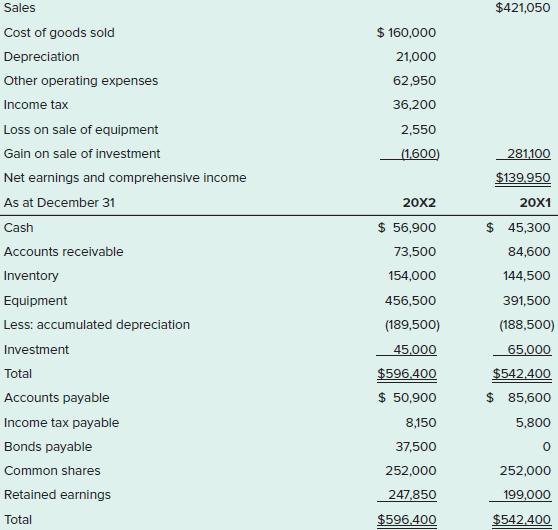

Grand Corp.’s 20X2 financial statements showed the following:

Additional information:

During the year, equipment with an original cost of $82,000 was sold for cash.

Required:

1. Prepare the SCF, in good form. Include required note disclosure of non-cash transactions. Omit the separate disclosure of cash flow for interest, investment income, and income tax. Make logical assumptions regarding the nature of change in asset, liability, and equity accounts.

2. Explain the company’s cash transactions for the year, based on the SCF.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Intermediate Accounting Volume 1

ISBN: 9781260306743

7th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod Dick

Question Posted: