Guas Inc., a major retailer of bicycles and accessories, operates several stores and is a publicly traded

Question:

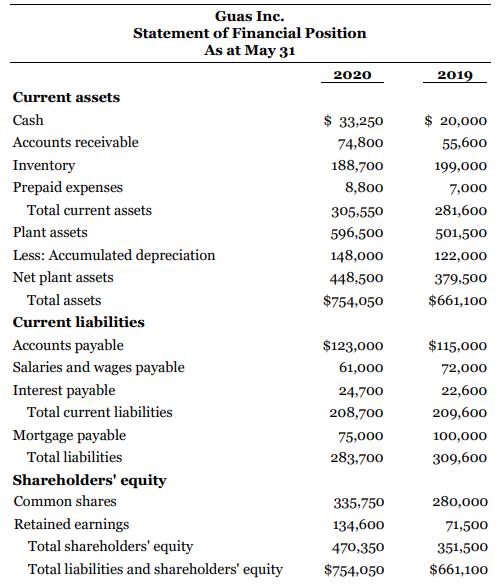

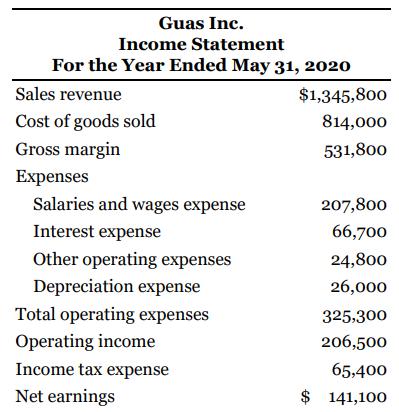

Guas Inc., a major retailer of bicycles and accessories, operates several stores and is a publicly traded company. The company is currently preparing its statement of cash flows. The comparative statement of financial position and income statement for Guas as at May 31, 2020, are as follows:

The following is additional information about transactions during the year ended May 31, 2020, for Guas Inc., which follows IFRS.

1. Plant assets costing $95,000 were purchased by paying $44,000 in cash and issuing 5,000 common shares.

2. The “other expenses” relate to prepaid items.

3. In order to supplement its cash, Guas issued 4,000 additional common shares.

4. There were no penalties assessed for the repayment of the mortgage.

5. Cash dividends of $78,000 were declared and paid at the end of the fiscal year.

Instructions

a. Compare and contrast the direct method and the indirect method for reporting cash flows from operating activities.

b. Prepare a statement of cash flows for Guas Inc. for the year ended May 31, 2020, using the direct method. Support the statement with appropriate calculations, and provide all required disclosures.

c. Using the indirect method, calculate only the net cash flow from operating activities for Guas Inc. for the year ended May 31, 2020.

d. Does Guas Inc. have a choice in how it classifies dividends paid on the statement of cash flows?

e. Assume that you are a shareholder of Guas Inc. What do you think of the dividend payout ratio that is highlighted in the statement of cash flows?

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781119497042

12th Canadian Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, Bruce J. McConomy