ND Paint Designs began operations on April 1, 2024. The company completed the following transactions in its

Question:

ND Paint Designs began operations on April 1, 2024. The company completed the following transactions in its first month:

Apr. 1 The owner, Nazim Dhaliwal, invested $12,800 cash in the company.

2 Purchased equipment for $5,000 on account.

2 Purchased a one-year insurance policy effective April 1, and paid the annual premium of $1,500.

2 Purchased $590 of supplies for cash.

7 Paid cash for $600 of advertising expenses.

8 Finished a painting project for Maya Angelina and collected $630 cash.

10 Received a $1,270 contract from a customer, SUB Terrain Inc., to paint its new office space. SUB Terrain will pay when the project is complete.

25 The owner, Nazim Dhaliwal, withdrew $960 cash for his use.

28 Completed the contract with SUB Terrain Inc. from April 10 and collected the amount owing.

29 Received $1,800 cash from Memphis Shek for a painting project that ND Paint Designs will start on May 5.

30 Paid for the equipment purchased on account on April 2.

Instructions

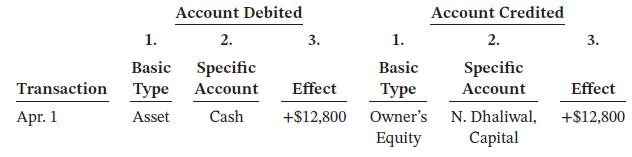

a. For each transaction, indicate:

(1) the basic type of account debited and credited (asset, liability, or owner’s equity);

(2) the specific account debited and credited (Cash, Rent Expense, Service Revenue, etc.);

(3) whether each account is increased (+) or decreased (−), and by what amount. Use the following format, in which the first transaction is given as an example:

b.

Prepare a journal entry for each transaction.

Taking It Further

Nazim doesn’t understand why a debit increases the Cash account and yet a credit to N. Dhaliwal, Capital increases that account. He reasons that debits and credits cannot both increase account balances. Explain to Nazim why he is wrong.

Step by Step Answer:

Accounting Principles Volume 1

ISBN: 9781119786818

9th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak