Refer to the data in P19.9, except now assume Dela Corporation reports under IFRS. Depending on what

Question:

Refer to the data in P19.9, except now assume Dela Corporation reports under IFRS. Depending on what your instructor assigns, do either parts (a), (b), (c), and (e) or parts (d) and (e).

Data From P19.9.

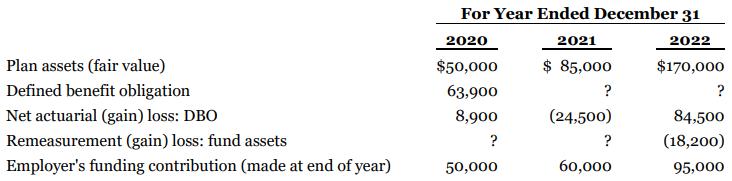

Dela Corporation initiated a defined benefit pension plan for its 50 employees on January 1, 2020. The insurance company that administers the pension plan provides the following information for the years 2020, 2021, and 2022:

There were no balances as at January 1, 2020, when the plan was initiated, because no credit was given for past service. The rate used to discount the company's pension obligation was 13% in 2020, 11% in 2021, and 8% in 2022. The service cost component of net periodic pension expense amounted to the following: 2020, $55,000; 2021, $85,000; and 2022, $119,000. No benefits were paid in 2020, but $30,000 was paid in 2021, and $35,000 in 2022. (All benefits were paid and all actuarial gains and losses were determined at the end of the year.) The company applies ASPE.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781119497042

12th Canadian Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, Bruce J. McConomy