The following information is available for Huntley Corporation's pension plan for the year 2020: Instructions a. Calculate

Question:

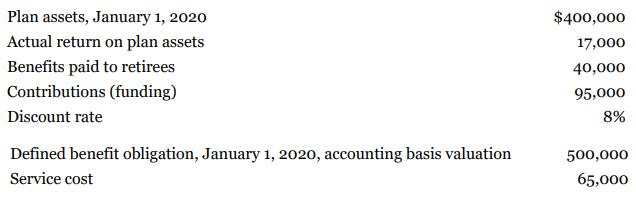

The following information is available for Huntley Corporation's pension plan for the year 2020:

Instructions

a. Calculate pension expense for the year 2020, and provide the entries to recognize the pension expense and funding for the year, assuming that Huntley follows IFRS.

b. Calculate pension expense for the year 2020, and provide the entries to recognize the pension expense and funding for the year, assuming that Huntley follows ASPE, and its accounting policy is to use an accounting basis valuation for its defined benefit obligation.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Intermediate Accounting Volume 2

ISBN: 9781119497042

12th Canadian Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, Bruce J. McConomy

Question Posted: