Boxwood Corp. had the following transactions for the year ended March 20X6: 1. A cash dividend of

Question:

Boxwood Corp. had the following transactions for the year ended March 20X6:

1. A cash dividend of $217,000 was declared and paid.

2. 70,000 additional common shares were issued in exchange for a property. The land was valued at $1,450,000. Common shares have been trading, on average, for $23.50 per share.

3. 4,500 preferred shares were purchased and retired for $60 per share.

4. A common stock dividend of 5% was issued. The stock dividend resulted in 2,300 shares having to be issued in the form of fractional share rights, still outstanding at year-end. The dividend was valued at $15 per share.

5. Earnings for the year were $3,218,000.

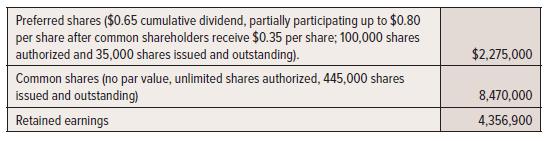

Items in shareholders’ equity at 31 March 20X6:

Required:

1. Determine the amount of cash dividend to the preferred shareholders, and the dividend to the common shareholders.

2. Calculate the final balance in each shareholders’ equity account.

3. Justify the value used to record the common shares issued.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781260881240

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel