Refer to the facts of A14-28. Data From Assignment14-28 Clean Energy Ltd. began 20X2 with shareholders equity

Question:

Refer to the facts of A14-28.

Data From Assignment14-28

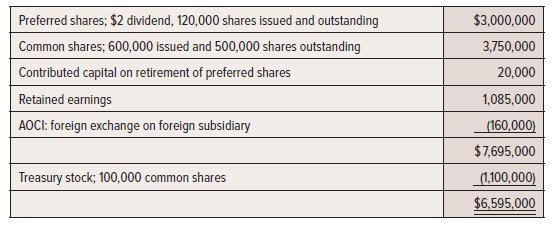

Clean Energy Ltd. began 20X2 with shareholders’ equity as follows:

The company’s tax rate is 40%. In 20X2, the company reported transactions that affected equity accounts:

1. Common shares, 2-for-1 stock split.

2. Common shares, 91,000 shares post-split, were repurchased and retired for $439,525.

3. All of the treasury shares were reissued for $1,087,700.

4. Clean reported earnings of $210,900, including an after-tax discontinued operation loss amount of $17,300. There was an after-tax foreign exchange gain of $65,500 related to the foreign subsidiary.

5. Cash dividends of $163,250 were paid. This represented the required dividend on the preferred shares plus some common share dividend.

6. After the dividend was paid, 30,000 preferred shares were repurchased and retired for $11.75 per share.

7. Share retirement costs, legal fees relating to both preferred and common shares, amounted to $66,500 for the year.

8. The company recorded an error correction during the year, resulting in a $45,000 pretax increase to prior year’s earnings.

Required:

Prepare the financing activities section of the SCF, including dividends paid.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781260881240

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel