An excerpt from Section 10.2 of the Management Discussion and Analysis in the 2017 annual report of

Question:

An excerpt from Section 10.2 of the Management Discussion and Analysis in the 2017 annual report of BCE Inc. is shown below. The excerpt shows summarized financial information, including calculations of earnings before interest, tax, depreciation, and amortization (EBITDA), and adjusted net earnings? both non-GAAP earnings measures. The company provides information on these calculations, which is also shown.

Instructions

Read the excerpts below. Discuss the pros and cons of management?s decision to report additional earnings numbers outside of the traditional audited financial statements. In the case of this company, in your opinion, do you think that this presentation provides good, useful information?

10.2 Non-GAAP financial measures . . .

This section describes the non-GAAP financial measures . . . we use in this MD&A to explain our financial results. It also provides reconciliations of the non-GAAP financial measures to the most comparable IFRS financial measures.

In Q1 2017, we updated our definition of adjusted net earnings and adjusted EPS to also exclude impairment charges as they may affect the comparability of our financial results and could potentially distort the analysis of trends in business performance. There was no impact to previously reported results as a result of this change.

Adjusted EBITDA and Adjusted EBITDA margin

The terms Adjusted EBITDA . . . do not have any standardized meaning under IFRS. Therefore, . . . [they] are unlikely to be comparable to similar measures presented by other issuers. We use Adjusted EBITDA . . . to evaluate the performance of our businesses as it reflects their ongoing profitability. We believe that certain investors and analysts use Adjusted EBITDA to measure a company?s ability to service debt and to meet other payment obligations or as a common measurement to value companies in the telecommunications industry. We believe that certain investors and analysts also use Adjusted EBITDA . . . to evaluate the performance of our businesses. Adjusted EBITDA is also one component in the determination of short-term incentive compensation for all management employees.

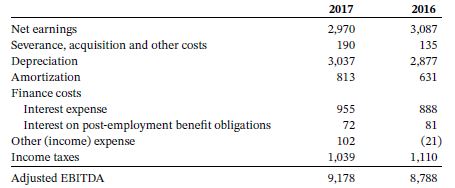

Adjusted EBITDA . . . has no directly comparable IFRS financial measure. Alternatively, the following table provides a reconciliation of net earnings to Adjusted EBITDA.

Adjusted net earnings and Adjusted EPS

The terms Adjusted net earnings and Adjusted EPS do not have any standardized meaning under IFRS. Therefore, they are unlikely to be comparable to similar measures presented by other issuers.

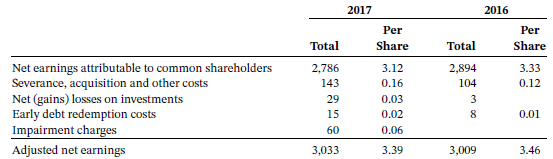

We define Adjusted net earnings as net earnings attributable to common shareholders before severance, acquisition and other costs, net (gains) losses on investments, and early debt redemption costs. We define Adjusted EPS as Adjusted net earnings per BCE common share.

We use Adjusted net earnings and Adjusted EPS, and we believe that certain investors and analysts use these measures, among other ones, to assess the performance of our businesses without the effects of severance, acquisition and other costs, net (gains) losses on investments, and early debt redemption costs, net of tax and non controlling interest (NCI). We exclude these items because they affect the comparability of our financial results and could potentially distort the analysis of trends in business performance. Excluding these items does not imply they are non-recurring.

The most comparable IFRS financial measures are net earnings attributable to common shareholders and EPS. The following table is a reconciliation of net earnings attributable to common shareholders and EPS to Adjusted net earnings on a consolidated basis and per BCE common share (Adjusted EPS), respectively.

Step by Step Answer:

Intermediate Accounting Volume 1

ISBN: 978-1119496496

12th Canadian edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, Bruce J. McConomy