During the current year, Garrison Construction Ltd. traded in two relatively new small cranes (cranes no. 6RT

Question:

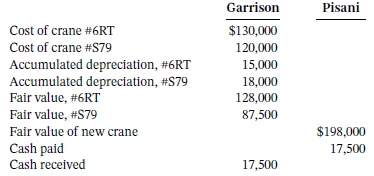

During the current year, Garrison Construction Ltd. traded in two relatively new small cranes (cranes no. 6RT and S79) for a larger crane that Garrison expects will be more useful for the particular contracts that the company has to fulfill over the next couple of years. The new crane was acquired from Pisani Manufacturing Inc., which has agreed to take the smaller equipment as trade-ins and also pay $17,500 cash to Garrison. The new crane cost Pisani $165,000 to manufacture and is classified as inventory. The following information is available:

Instructions

a. Assume that this exchange has commercial substance. Prepare the journal entries on the books of (1) Garrison Construction and (2) Pisani Manufacturing. Pisani uses a perpetual inventory system.

b. Assume that this exchange lacks commercial substance. Prepare the journal entries on the books of (1) Garrison Construction and (2) Pisani Manufacturing. Pisani uses a perpetual inventory system.

c. Digging Deeper Assume that you have been asked to recommend whether it is more appropriate for the transaction to have commercial substance or not to have commercial substance. Develop arguments that you could present to the controllers of both Garrison Construction and Pisani Manufacturing to justify both alternatives. Which arguments are more persuasive?

Step by Step Answer:

Intermediate Accounting Volume 1

ISBN: 978-1119496496

12th Canadian edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, Bruce J. McConomy