Best Buy Co, Inc., is a leading retailer specializing in consumer electronics. A condensed income statement and

Question:

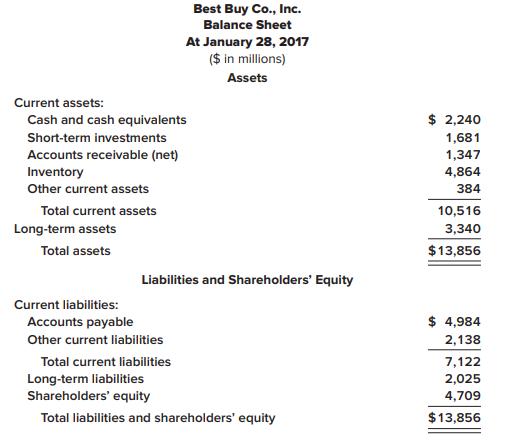

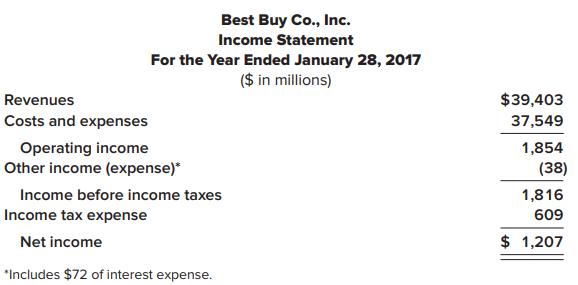

Best Buy Co, Inc., is a leading retailer specializing in consumer electronics. A condensed income statement and balance sheet for the fiscal year ended January 28, 2017, are shown next.

Liquidity and solvency ratios for the industry are as follows:

Industry Average

Current ratio 1.43

Acid-test ratio 1.15

Debt to equity 0.68

Times interest earned 8.25 times

Required:

1. Determine the following ratios for Best Buy for its fiscal year ended January 28, 2017.

a. Current ratio

b. Acid-test ratio

c. Debt to equity ratio

d. Times interest earned ratio

2. Using the ratios from requirement 1, assess Best Buy’s liquidity and solvency relative to its industry

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

Intermediate Accounting

ISBN: 978-1260481952

10th edition

Authors: J. David Spiceland, James Sepe, Mark Nelson, Wayne Thomas