Bill Jovi is reviewing the cash accounting for Nottleman, Inc., a local mailing service. Jovis review will

Question:

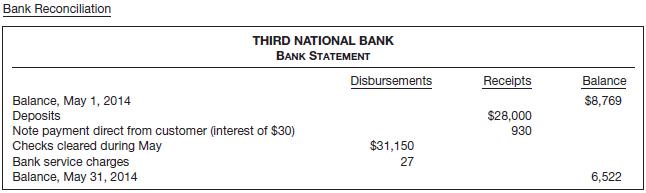

Bill Jovi is reviewing the cash accounting for Nottleman, Inc., a local mailing service. Jovi’s review will focus on the petty cash account and the bank reconciliation for the month ended May 31, 2014. He has collected the following information from Nottleman’s bookkeeper for this task.

Petty Cash

1. The petty cash fund was established on May 10, 2014, in the amount of $250.

2. Expenditures from the fund by the custodian as of May 31, 2014, were evidenced by approved receipts for the following.

Postage expense $33.00

Mailing labels and other supplies 65.00

I.O.U. from employees 30.00

Shipping charges (to customer) 57.45

Newspaper advertising 22.80

Miscellaneous expense 15.35

On May 31, 2014, the petty cash fund was replenished and increased to $300; currency and coin in the fund at that time totaled $26.40.

Nottleman’s Cash Account

Balance, May 1, 2014 $ 8,850

Deposits during May 2014 31,000

Checks written during May 2014 (31,835)

Deposits in transit are determined to be $3,000, and checks outstanding at May 31 total $850. Cash on hand (besides petty cash) at May 31, 2014, is $246.

Instructions

(a) Prepare the journal entries to record the transactions related to the petty cash fund for May.

(b) Prepare a bank reconciliation dated May 31, 2014, proceeding to a correct cash balance, and prepare the journal entries necessary to make the books correct and complete.

(c) What amount of cash should be reported in the May 31, 2014, balance sheet?

Step by Step Answer:

Intermediate Accounting

ISBN: 978-1118147290

15th edition

Authors: Donald E. Kieso, Jerry J. Weygandt, and Terry D. Warfield