Delta Catfish Company has taken a position in its tax return to claim a tax credit of

Question:

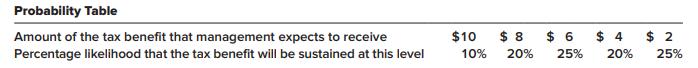

Delta Catfish Company has taken a position in its tax return to claim a tax credit of $10 million (direct reduction in taxes payable) and has determined that its sustainability is “more likely than not,” based on its technical merits. Delta has developed the probability table shown below of all possible material outcomes ($ in millions):

Delta’s taxable income is $84 million for the year. Its effective tax rate is 25%. The tax credit would be a direct reduction in current taxes payable.

Required:

1. At what amount would Delta measure the tax benefit in its income statement?

2. Prepare the appropriate journal entry for Delta to record its income taxes for the year.

Step by Step Answer:

Intermediate Accounting

ISBN: 978-1260481952

10th edition

Authors: J. David Spiceland, James Sepe, Mark Nelson, Wayne Thomas