Golf Is Great Corp. sells bonds to friends and families to finance the acquisition of a driving

Question:

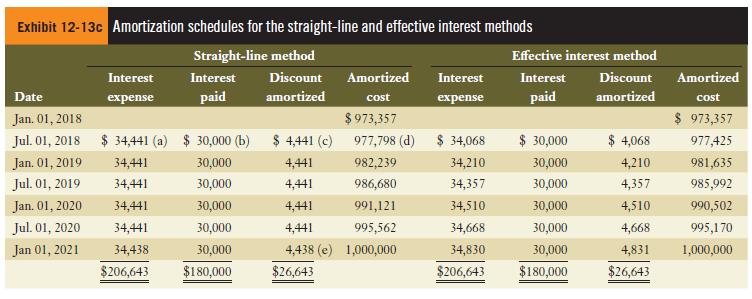

Golf Is Great Corp. sells bonds to friends and families to finance the acquisition of a driving range. On January 1, 2018, Golf Is Great sells $3,000,000 in four-year, 5% bonds priced to yield 4% for $3,109,882. Interest is payable on June 30 and December 31 each year. The corporate year-end is December 31.

Golf Is Great is a private corporation and the bonds are not publicly traded. As such, Golf Is Great may elect to use either the straight-line or effective interest method to amortize the premium.

Required:

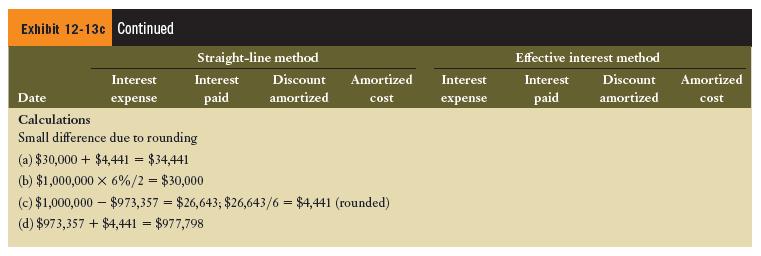

a. Complete a bond amortization spreadsheet that contrasts the use of the straight-line method and the effective interest method. Use the format that follows as employed in Exhibit 12-13c

b. Review your results tabulated in part (a). Does the choice of methods affect:

i. Cash flow for each of the periods, and if so how?

ii. The total interest expense over the life of the bond, and if so how?

iii. Reported profitability on a year-to-year basis, and if so how?

Exhibit 12-13c

Step by Step Answer: