Income statement and balance sheet information abstracted from a recent annual report of Wolverine World Wide, Inc.,

Question:

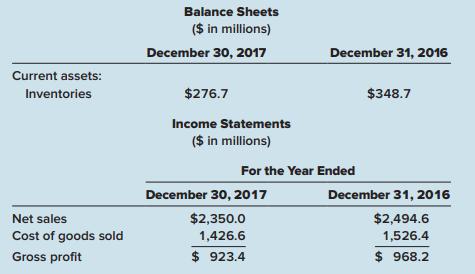

Income statement and balance sheet information abstracted from a recent annual report of Wolverine World Wide, Inc., appears below:

The significant accounting policies note disclosure contained the following:

Inventories

The Company used the LIFO method to value inventories of $53.2 million at December 30, 2017 and $66.2 million at December 31, 2016. During fiscal 2017, a reduction in inventory quantities resulted in a liquidation of applicable LIFO inventory quantities carried at lower costs in prior years. This LIFO liquidation decreased cost of goods sold by $6.0 million. If the FIFO method had been used, inventories would have been $16.4 million and $22.4 million higher than reported at December 30, 2017 and December 31, 2016, respectively

Required:

1. Why is Wolverine disclosing the FIFO cost of its LIFO inventory?

2. Calculate what beginning inventory and ending inventory would have been for the year ended December 31, 2017, if Wolverine had used FIFO for all of its inventories.

3. Calculate what cost of goods sold and gross profit would have been for the year ended December 31, 2017, if Wolverine had used FIFO for all of its inventories.

4. In 2017, Wolverine reported a LIFO liquidation. Why do companies separately disclose LIFO liquidations due to declines in the quantity of ending inventory?

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Liquidation

Liquidation in finance and economics is the process of bringing a business to an end and distributing its assets to claimants. It is an event that usually occurs when a company is insolvent, meaning it cannot pay its obligations when they are due....

Step by Step Answer:

Intermediate Accounting

ISBN: 978-1260481952

10th edition

Authors: J. David Spiceland, James Sepe, Mark Nelson, Wayne Thomas