Raleigh Department Store uses the conventional retail method for the year ended December 31, 2019. Available information

Question:

Raleigh Department Store uses the conventional retail method for the year ended December 31, 2019. Available information follows:

a. The inventory at January 1, 2019, had a retail value of $45,000 and a cost of $27,500 based on the conventional retail method.

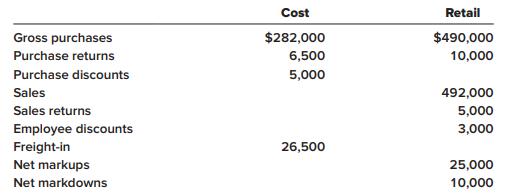

b. Transactions during 2019 were as follows:

Sales to employees are recorded net of discounts.

c. The retail value of the December 31, 2020, inventory was $56,100, the cost-to-retail percentage for 2020 under the LIFO retail method was 62%, and the appropriate price index was 102% of the January 1, 2020, price level.

d. The retail value of the December 31, 2021, inventory was $48,300, the cost-to-retail percentage for 2021 under the LIFO retail method was 61%, and the appropriate price index was 105% of the January 1, 2020, price level.

Required:

1. Estimate ending inventory for 2019 using the conventional retail method.

2. Estimate ending inventory for 2019 assuming Raleigh Department Store used the LIFO retail method.

3. Assume Raleigh Department Store adopts the dollar-value LIFO retail method on January 1, 2020. Estimate ending inventory for 2020 and 2021.

Step by Step Answer:

Intermediate Accounting

ISBN: 978-1260481952

10th edition

Authors: J. David Spiceland, James Sepe, Mark Nelson, Wayne Thomas