The shareholders equity portion of the balance sheet of Sessels Department Stores, Inc., a large regional specialty

Question:

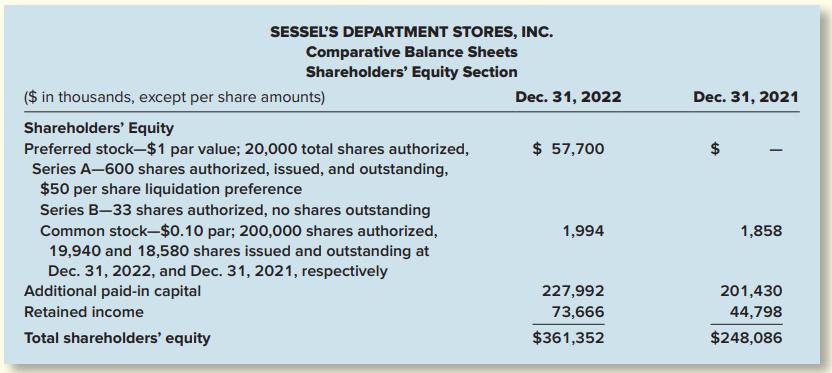

The shareholders’ equity portion of the balance sheet of Sessel’s Department Stores, Inc., a large regional specialty retailer, is as follows:

Disclosures elsewhere in Sessel’s annual report revealed the following changes in shareholders’ equity accounts for 2022, 2021, 2020

2022:

1. The only changes in retained earnings during 2022 were preferred dividends on preferred stock of $3,388,000 and net income.

2. The preferred stock is convertible. During the year, 6,592 shares were issued. All shares were converted into 320,000 shares of common stock. No gain or loss was recorded on the conversion.

3. Common shares were issued in a public offering and upon the exercise of stock options. On the statement of shareholders’ equity, Sessel’s reports these two items on a single line entitled: “Issuance of shares.”

2021:

1. Net income: $12,126,000.

2. Issuance of common stock: 5,580,000 shares at $112,706,000.

2020:

1. Net income: $13,494,000.

2. Issuance of common stock: 120,000 shares at $826,000.

Required:

From these disclosures, prepare comparative statements of shareholders’ equity for 2022, 2021, and 2020.

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

Intermediate Accounting

ISBN: 978-1260481952

10th edition

Authors: J. David Spiceland, James Sepe, Mark Nelson, Wayne Thomas