McGuire Corporation began operations in 2024. The company purchases computer equipment from manufacturers and then sells to

Question:

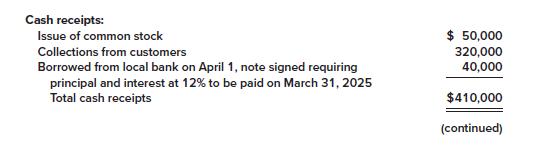

McGuire Corporation began operations in 2024. The company purchases computer equipment from manufacturers and then sells to retail stores. During 2024, the bookkeeper used a check register to record all cash receipts and cash disbursements. No other journals were used. The following is a recap of the cash receipts and disbursements made during the year.

You are called in to prepare financial statements on December 31, 2024. The following additional information was provided to you:

1. Customers owed the company $22,000 at year-end.

2. At year-end, $30,000 was still due to suppliers of inventory purchased on credit.

3. At year-end, inventory costing $50,000 still remained on hand.

4. Salaries owed to employees at year-end amounted to $5,000.

5. On December 1, $3,000 in rent was paid to the owner of the building used by McGuire. This represented rent for the months of December through February.

6. The office equipment, which has a ten-year life and no salvage value, was purchased on January 1, 2024. Straight-line depreciation is used.

Required:

Prepare an income statement for 2024 and a balance sheet as of December 31, 2024.

Step by Step Answer: