Microsofts 2020 10-K includes the following information relevant to its available-for-sale investments in Note 17Accumulated Other Comprehensive

Question:

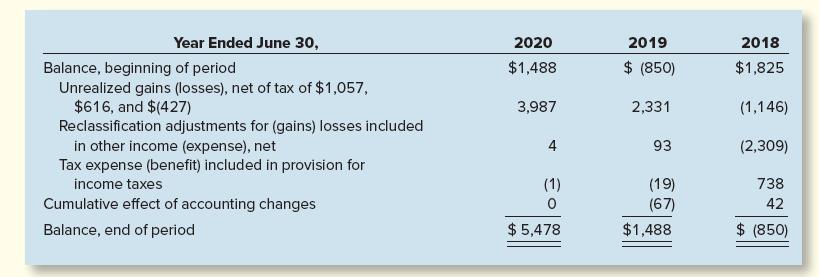

Microsoft’s 2020 10-K includes the following information relevant to its available-for-sale investments in Note 17—Accumulated Other Comprehensive Income (Loss):

Required:

1. Prepare a journal entry to record unrealized gains for 2020. (Hint: $3,987 is net of tax effects, so you will need to add back tax effects to show the amount of pretax unrealized gain.)

2. Prepare a journal entry to record Microsoft’s reclassification adjustment for 2020 (pretax).

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: