Following is a brief description of two companies: Company A This company is growing rapidly in the

Question:

Following is a brief description of two companies:

Company A This company is growing rapidly in the computer software industry. Although the company began more than 15 years ago as a relatively small operation producing peripheral computer equipment, it was acquired by one of the leaders in the computer industry. Three years ago the parent company switched the emphasis in this subsidiary to software production. Although competition in this market can be described as fierce, the company has done well. In order to make the switch, the parent company ‘‘cleaned house” and completely restructured the management of the subsidiary. Subsequently, there was a complete turnover in staff.

Two factors are now affecting the performance of the company. However, each factor has somewhat of an opposite effect. First, the profitability of the company has been linked to the “lean and mean” philosophy of its new management. Expenses are kept to a bare minimum, especially payroll. Like the Marines, management hires ‘‘a few good men.”’

Although they work very hard, they seem always to be behind schedule. Management, however, dismisses this observation with the explanation that all such companies are behind schedule. ‘‘Besides,”’ they say, “why argue with success? The company is making money.”

The second factor is an observation by the parent company’s management that the software industry is thinning out, leaving only the best to compete in an even fiercer environment.

The parent company’s management has told subsidiary management that it must rank in the top 10 software houses in total revenues and profits or face another change. The subsidiary now ranks 15th.

Company B This company, a small-town bank, is owned by a large Midwestern bank located in Chicago. The subsidiary bank was founded in 1905 and has remained the only banking institution in the small farming community since that time. Interestingly, the management of the bank has been maintained within the same two prominant families since the bank’s founding. The community had a population of 6,804 in 1905. The 1980 census listed the population as 7,967. The bank’s profitability has been exceptional in years past, but in recent years, the squeeze on the nation’s agricultural businesses has also had its effect on this small bank. The bank does, however, remain profitable and is still described by management as healthy, although its profitability has slipped below what it experienced in prior years.

Management prides itself on its careful, conservative management philosophy. The president of the bank, who also is the chairman of the board of directors, is well respected by the parent bank in Chicago. He serves on the board of that large institution. Recently, this revered member of the Midwestern banking community was overheard lamenting the fact that his own bank faces three primary problems, and if these problems could be “whipped,” then the whole world would be just about perfect and he could afford to retire and let his eldest daughter take charge.

Problem 1. ‘These newfangled computers have my banking staff just plain bumfuzzled.

As you know, these people have been with the bank for years, and the only one who knows anything about computers is young Ben Goode. He just got out of business college, and we are still teaching him the ropes. The bookkeeping has gotten so complicated with all the computer foul-ups that we haven’t been able to get a decent listing of our outstanding loans for the last two months. We had to go back by hand and reconstruct the list as best we could. I am still not sure we got it right. We don’t have the darn computer working right yet.”’

Problem 2. ‘‘This new tractor assembly plant being put in near our town is going to attract more than 150 new families to the area. That is going to put a strain on our bank, trying to find enough trained people who understand banking in a community like ours who can serve the additional families and businesses coming in.”’

Problem 3. “This thing with Miss Sparrow. She’s been with the bank for so many years —— who would have thought this could happen? Her trial is coming up next week. We found out she’d been taking money from our customers’ accounts for more than 21 years.

Can you imagine? It is still hard for me to get used to. And you know, she used to be a good friend of the family, before all this bad news came out.”

Required:

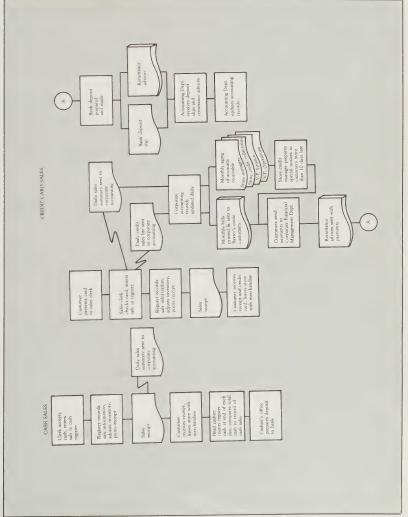

Assume you are an internal auditor of the parent company in each case. You have been assigned to conduct an audit of the operations of each of the subsidiaries. From the list of 18 risk factors given in the chapter, choose the five for each subsidiary that you think are likely to be the most relevant in assessing the level of risk associated with that company.

The same five do not necessarily have to be chosen for both companies. Defend your selections.

Step by Step Answer:

Internal Auditing: Principles And Techniques

ISBN: 9780894131677

1st Edition

Authors: Richard L. Ratliff, W. Wallace, Walter B. Mcfarland, J. Loeboecke