Bert and Ernie formed a partnership in 2019 to produce and sell puppets. At the time the

Question:

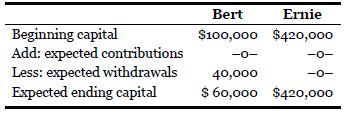

Bert and Ernie formed a partnership in 2019 to produce and sell puppets. At the time the partnership was formed, it was agreed all income and losses would be allocated based on the following: Bert would oversee the day-to-day operations, for which he would receive a salary allowance of $30,000. Ernie, on the other hand, provided most of the capital to start the business, so he will receive an interest allowance of 9 percent of his beginning capital balance. Finally, the partners agreed that the remainder would be allocated in the proportion of the ending capital balances before allocation. The beginning capital balances and expected ending capital balances of the partners before income allocation are

Required:

A. Determine expected ending capital balances if the partners predict a business income of $50,000 for the period.B. Determine expected ending capital balances if the partners predict a business income of $150,000 for the period.C. Determine expected ending capital balances if the partners predict a business loss of $20,000 for the period.

Step by Step Answer:

Introduction To AccountingAn Integrated Approach

ISBN: 9781119600107

8th Edition

Authors: Penne Ainsworth, Dan Deines