Josephine, the CEO of a microchip manufacturer, is weighing an offer from Huawei, one of the largest

Question:

Josephine, the CEO of a microchip manufacturer, is weighing an offer from Huawei, one of the largest smartphone manufacturers in the world. The Huawei purchasing manager says that if Josephine’s company would be willing to retool her plant to better serve Huawei, Huawei would buy more chips from her at a higher price. The downside is that Josephine’s company couldn’t then sell their chips to Samsung because the new chips don’t meet Samsung’s specifications.

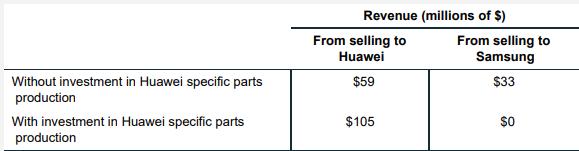

The manufacturer’s revenue from selling to Huawei and Samsung, both with and without retooling the plant, are provided in the table below. For simplicity, assume that all other costs are equal between the two options.

a. How much revenue would the manufacturer make if Josephine decides not to make the investment to retool the plant? What if she did make the investment?

b. What is the most Josephine would be willing to spend on the investment? Assume that she would be willing to make the investment as long as it does not make her company worse off.

c. Once the investment is made, will her bargaining power as a supplier to Huawei increase or decrease?

d. Suppose Josephine goes ahead with the investment at a cost of $10 million. Afterward, Huawei tells her they are unwilling to pay the initial price they stated and are only willing to pay a lower price which results in only $100 million in revenue. In hindsight, should the CEO have made the investment?

e. What could Josephine have done to make sure her company did not experience this hold-up problem?

Step by Step Answer: