Barry and the Wild Bunch Limited, with its head office in Ottawa, Ontario and other permanent establishments

Question:

Barry and the Wild Bunch Limited, with its head office in Ottawa, Ontario and other permanent establishments in the provinces of New Brunswick and Quebec, and in the United States, has taxable income of $325,000.

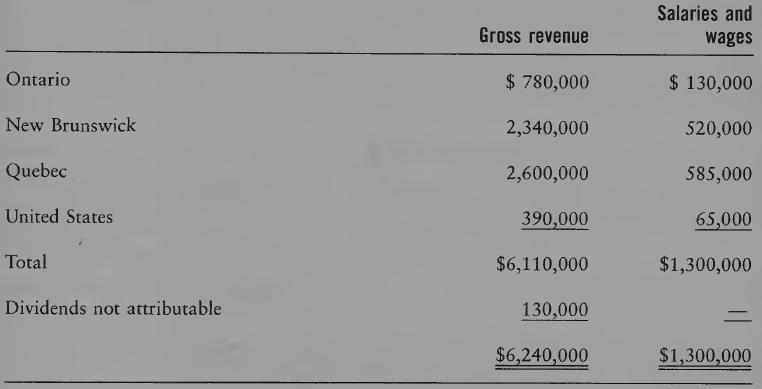

Assume that the corporation’s gross revenue and salaries and wages are attributable to its permanent establishments as follows:

REQUIRED

Compute the amount of the company’s taxable income attributable to each province and determine the amount of the company’s abatement.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Introduction To Federal Income Taxation In Canada 2016-2017

ISBN: 9781554968725

37th Edition

Authors: Robert E. Beam, Stanley N. Laiken, James J. Barnett

Question Posted: