The following information has been taken from the financial records of the FT Limited: In 2015, capital

Question:

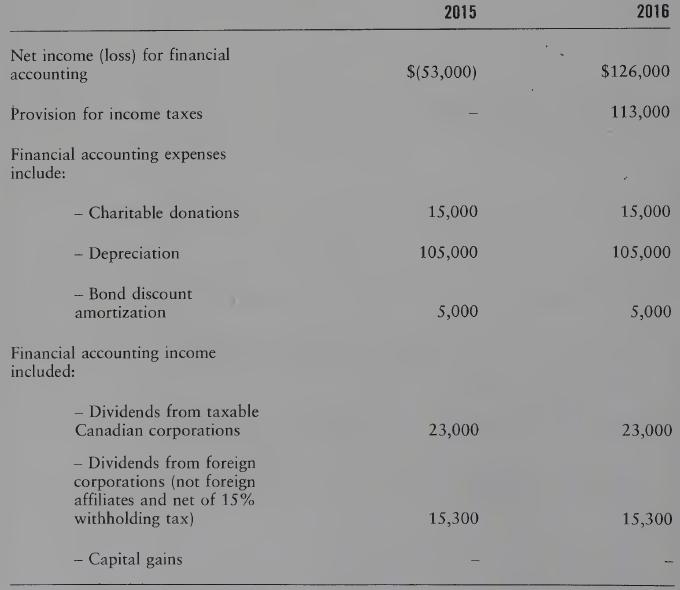

The following information has been taken from the financial records of the FT Limited:

In 2015, capital cost allowance of $10,278 had been taken on a brick building purchased in 2012 (Class 1 (separate): 6%) leaving an undepreciated capital cost balance of $246,667 on January 1, 2016, the beginning of the 2016 taxation year. In addition, $44,800 in capital cost allowance had been taken on equipment leaving an undepreciated capital cost balance of $179,200 on January 1, 2016. In 2016 no additions or disposals were made to these classes of assets.

The corporation had non-capital losses of $18,000 available for carryover until 2029 and a 2010 net capital loss of $5,000 available for carryover.

REQUIRED

Calculate the taxable income of the corporation for the years indicated.

Step by Step Answer:

Introduction To Federal Income Taxation In Canada 2016-2017

ISBN: 9781554968725

37th Edition

Authors: Robert E. Beam, Stanley N. Laiken, James J. Barnett