A. Cherry owned a farmhouse and land, the latter being used by him and his sons, Tom

Question:

A. Cherry owned a farmhouse and land, the latter being used by him and his sons, Tom and Leo, in carrying on a fruit and poultry business in partnership. The partnership agreement stipulated that the father should take one-sixth of the profits, such to be not less than £1,200 per annum, the sons sharing the remainder equally.

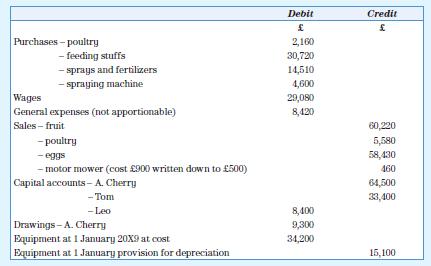

The following are extracts from the trial balance of the business as on 31 December 20X9:

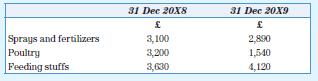

Inventories on hand were as follows:

Additional information

1. Drawings by Tom and Leo have been £150 and £140 per week, respectively. The amounts have been included in the wages account. Of the wages, one-quarter is to be charged to the fruit department and three-quarters to the poultry department.

2. The father and son Tom live in the farmhouse and are to be charged jointly per annum £300 for fruit, and £680 for eggs and poultry, such charges being shared equally. Leo is to be charged £380 for fruit and £620 for eggs and poultry.

3. Independent of the partnership, Leo kept some pigs on the farm and in respect of this private venture he is to be charged £1,400 for feeding stuffs and £400 for wages.

4. A. Cherry is to be credited with £3,600 for rent of the land (to be charged as two-thirds to the fruit and one-third to the poultry departments), and Tom is to be credited with £840 by way of salary for packing eggs and dressing poultry.

5. Eggs sold in December 20X9 and paid for in January 20Y0 amounted to £2,430 and this sum was not included in the trial balance.

6. An account to 31 December 20X9 for £240 was received from a veterinary surgeon after the trial balance had been prepared. This account included a sum of £140 in respect of professional work as regards Leo’s pigs, which he himself paid.

7. Annual provision was to be made for depreciation on equipment at 10 per cent on cost at the end of the year.

Required

a. A trading account (showing separately the trading profit on the fruit and poultry departments) and appropriation accounts for the year ended 31 December 20X9.

b. The partners’ capital accounts in columnar form showing the balances as on 31 December 20X9.

Step by Step Answer:

Introduction To Financial Accounting

ISBN: 9781526803009

9th Edition

Authors: Anne Marie Ward, Andrew Thomas