Simon, Wilson and Dillon are in partnership. The following trial balance has been prepared on 31 December

Question:

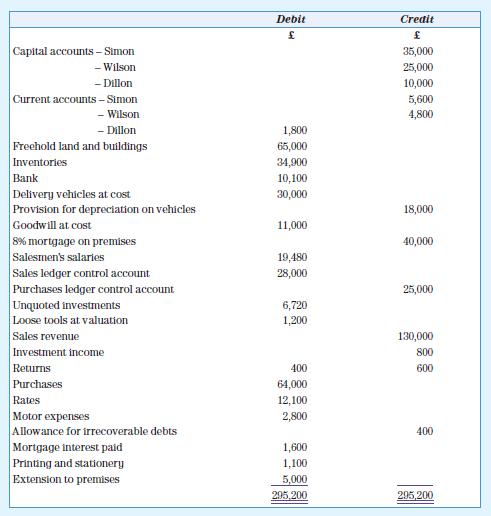

Simon, Wilson and Dillon are in partnership. The following trial balance has been prepared on 31 December 20X9:

Additional information

1. The inventory at 31 December 20X9 was valued at £31,000.

2. There is investment income accrued at 31 December 20X9 of £320.

3. The inventory of stationery at 31 December 20X9 was £170.

4. At the same date there were motor expenses accrued of £240 and rates paid in advance of £160.

5. The allowance for irrecoverable debts at 31 December 20X9 is to be adjusted to 2 per cent of trade receivables.

6. Mortgage interest accrued should be provided for at the end of the year.

7. Depreciation on vehicles, on a strict time basis, is 10 per cent per annum using the straight-line method.

8. The loose tools in inventory at 31 December 20X9 were valued at £960.

9. The following errors have been found:

a. unrecorded in the ledger is the sale of a delivery vehicle on credit on 1 November 20X9 for £1,900 – this vehicle cost £2,400 when it was purchased on 1 April 20X7;

b. irrecoverable debts for this year of £2,000 have not been written off;

c. bank charges of £130 have been omitted from the books.

Simon and Dillon are to be allocated salaries of £15,000 and £10,000 per annum, respectively.

All partners will be entitled to interest on capital of 10 per cent per annum. The remaining profit or loss is shared between Simon, Wilson and Dillon in the ratio of 2 : 2 : 1, respectively.

Required

Prepare in vertical form a statement of profit or loss and appropriation account for the year ended 31 December 20X9 and a statement of financial position at that date.

Step by Step Answer:

Introduction To Financial Accounting

ISBN: 9781526803009

9th Edition

Authors: Anne Marie Ward, Andrew Thomas