Brick, Stone and Breeze carry on a manufacturing business in partnership, sharing profits and losses: Brick one-half,

Question:

Brick, Stone and Breeze carry on a manufacturing business in partnership, sharing profits and losses: Brick one-half, Stone one-third and Breeze one-sixth. It is agreed that the minimum annual share of profit to be credited to Breeze is to be £2,200, and any deficiency between this figure and her true share of the profits is to be borne by the other two partners in the ratio that they share profits. No interest is to be allowed or charged on partners’ capital or current accounts.

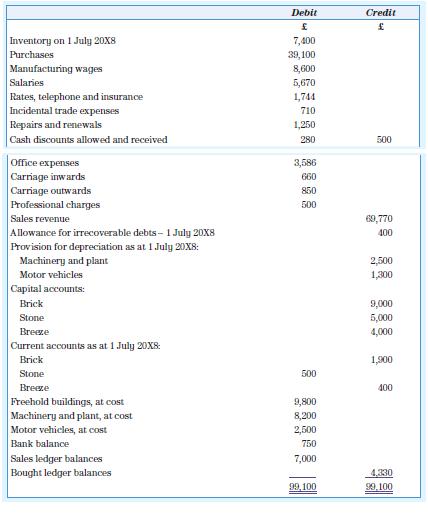

The trial balance of the firm as on 30 June 20X9 was as follows:

Additional information

1. An amount of £3,000, for goods sent out on sale or return, has been included in sales.

These goods were charged out to customers at cost plus 25 per cent and they were still in the customers’ hands on 30 June 20X9, unsold.

2. Included in the item Repairs and renewals is an amount of £820 for an extension to the factory.

3. Telephone and insurance paid in advance amounted to £424 and £42 was owing in respect of a trade expense.

4. A receivable of £80 has turned out to be irrecoverable and is to be written off.

5. The allowance for irrecoverable debts is to be increased to £520.

6. Provision for depreciation on machinery and plant and on motor vehicles is to be made at the rate of 10 per cent and 20 per cent per annum, respectively, on the cost.

7. The value of the inventory on hand on 30 June 20X9 was £7,238.

8. Each month Brick has drawn £55, Stone £45 and Breeze £20, and the amounts have been included in salaries.

Required

a. Prepare the statement of profit or loss for the year ended 30 June 20X9.

b. Write up the partners’ current accounts, in columnar form, for the year.

c. Draw up the statement of financial position as on 30 June 20X9.

Step by Step Answer:

Introduction To Financial Accounting

ISBN: 9781526803009

9th Edition

Authors: Anne Marie Ward, Andrew Thomas