The partnership of Anna, Mary and Seamus has just completed its first year in business. In their

Question:

The partnership of Anna, Mary and Seamus has just completed its first year in business. In their partnership agreement each partner is entitled to interest on capital of 12% each year and Anna is to get a salary of £30,000. Any profits or losses after this should be apportioned half to Anna, one-third to Mary and one-sixth to Seamus.

The following information relates to their first year of trading. Their year end is 31 July 20X9.

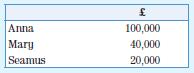

1. The partners introduced the following amounts as capital on 1 August 20X8:

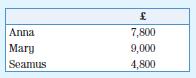

2. Cash drawings during the year were:

3. The draft statement of profit or loss for the year showed a profit for the year of £123,440.

4. Included in the repairs and renewals account for the year was a bill for £600 that related to Mary’s private motoring expenses.

5. No entries had been made in the financial statements to record the following:

a. Anna had accepted a trip provided by Bass, a credit customer of the partnership. The trip, which was valued at £2,000, was accepted in full settlement of a debt of £5,000 that Bass owed to the partnership. Bass is in financial difficulty and is unable to pay the £5,000.

b. As a result of a cash flow problem during April, Mary invested a further £20,000 as capital with effect from 1 May 20X9, and on the same date Seamus brought into the business a motor vehicle at an agreed valuation of £24,000. In addition, in order to settle a debt, Seamus had privately undertaken some work for Allen, a creditor of the partnership. Allen accepted the work as full settlement of the £24,000 the partnership owed him.

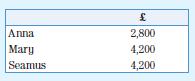

c. Each partner had taken goods for their own use during the year at cost as follows:

Motor vehicles are to be depreciated at 10% per annum using the straight line method. It is partnership policy to charge a full year’s depreciation in the year of purchase but none in the year of sale.

Required

a. The corrected profit for the first year of trade.

b. The appropriation account for the year ended 31 July 20X9.

c. The capital and current accounts of Anna, Mary and Seamus for the year ended 31 July 20X9.

Step by Step Answer:

Introduction To Financial Accounting

ISBN: 9781526803009

9th Edition

Authors: Anne Marie Ward, Andrew Thomas