Presented as follows are 12 financial ratios for two companies in separate industries. Ford Motor Company manufactures

Question:

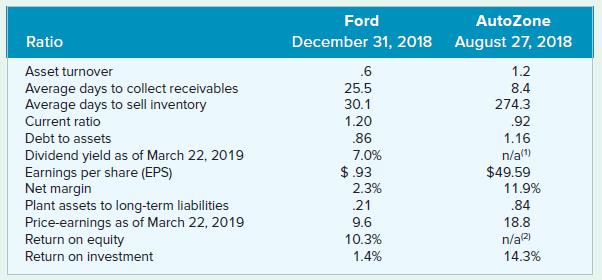

Presented as follows are 12 financial ratios for two companies in separate industries. Ford Motor Company manufactures automobiles and sells them to retail dealers. AutoZone, Inc. sells automobile parts and car-care products directly to consumers.

Required

a. Determine which company appears to be the most profitable. Explain the reasons for your decision, and include any needed discussion of the difficulties of comparing ratios from these two companies.

b. Determine which company appears to be using its assets most efficiently. Explain the reasons for your decision, and include any needed discussion of the difficulties of comparing ratios from these two companies.

c. Determine which company appears to have the greater financial risk. Consider both short-term and long-term financial risk. Explain the reasons for your decision, and include any needed discussion of the difficulties of comparing ratios from these two companies.

d. Based on these ratios only, which company do you think is the better investment opportunity? Explain the reasons for your decision, and include any needed discussion of the difficulties of comparing ratios from these two companies.

Step by Step Answer:

Introductory Financial Accounting For Business

ISBN: 9781260575309

2nd Edition

Authors: Thomas Edmonds, Christopher Edmonds, Mark Edmonds, Jennifer Edmonds, Philip Olds