Northwest Sales had the following transactions in Year 1: 1. The business was started when it acquired

Question:

Northwest Sales had the following transactions in Year 1:

1. The business was started when it acquired $200,000 cash from the issue of common stock.

2. Northwest purchased $900,000 of merchandise for cash in Year 1.

3. During the year, the company sold merchandise for $1,200,000. The merchandise cost $710,000. Sales were made under the following terms:

a. $520,000 Cash sales

b. 380,000 Credit card sales

c. 300,000 Sales on account

4. The company collected all the amount receivable from the credit card company.

5. The company collected $210,000 of accounts receivable.

6. The company paid $190,000 cash for selling and administrative expenses.

7. Determined that 5 percent of the ending accounts receivable balance would be uncollectible.

Required

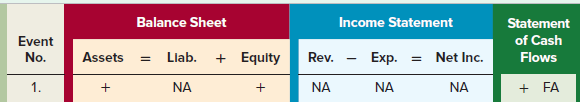

a. Show the effects of each of the transactions on the elements of the financial statements, using a horizontal statements model like the one shown next. Use + for increase, − for decrease, and NA for not affected. The first transaction is entered as an example.

b. Prepare an income statement, statement of changes in stockholders’ equity, balance sheet, and statement of cash flows for Year 1.

Accounts ReceivableAccounts receivables are debts owed to your company, usually from sales on credit. Accounts receivable is business asset, the sum of the money owed to you by customers who haven’t paid.The standard procedure in business-to-business sales is that...

Step by Step Answer:

Introductory Financial Accounting for Business

ISBN: 978-1260299441

1st edition

Authors: Thomas Edmonds, Christopher Edmonds